Friday, July 29, 2005

Solar Power Breakthrough?

An Aside: Regarding the Chevron article below. Perhaps Congress will hold the oil companies accountable in some way for not disclosing the dangers of diminishing supplies. Perhaps Chevron wants to stand out as the "good guy"?

By the way, oil prices have doubled since 2003.

Solar Power BreakthroughNew Low-Cost Solar Energy May Replace Gas

Will solar energy ever overtake the oil market? The solar revolution may be closer than you think.

Breakthrough solar power technology developed by International Automated Systems, Inc. [IAUS: OTCBB] may become the first solar to compete with gas. Low-cost energy produced by IAUS’s new patented and patent-pending solar technology can be used to generate electricity or produce clean fuels such as hydrogen and green methanol (gasoline replacements) at a competitive price.

IAUS’s unique thin-film solar panels can be produced at a fraction of the cost of today's photovoltaic solar panels. IAUS is on schedule to begin mass production of its solar panels by September 2005. Once in production, IAUS will be able to turn out nearly 200 megawatts of solar panels yearly. Nearly ten times greater capacity than a $100 million photovoltaic fabrication plant.

A solar area of only 100 miles squared- a size of land that equals only nine percent (9%) of the state of Nevada- can generate enough electricity for the entire United States.

"The discovery of economical solar energy is more valuable than oil," said Neldon Johnson, President and CEO of International Automated Systems, Inc. "The sun’s energy is free, clean and virtually unlimited. IAS’s new solar technology is a discovery of historical proportions that we hope will revolutionize energy production throughout the world."

The world energy market is $3 trillion dollars per year. This $3 trillion does not represent nearly 30% of the world without electricity.About International Automated Systems, Inc. (www.iaus.com; IAUS:OB)

Founded in 1988, International Automated Systems, Inc., develops high-technology products for diverse markets such as energy production, wireless communications, consumer purchasing and financial transactions. The company, founded by a former AT&T communications engineer, is based in Salem, Utah.

Wednesday, July 27, 2005

Wal-Mart & Chevron Making Moves - Sort of

Wal-Mart Deploys Solar, Wind, Sustainable Design

http://www.renewableenergyaccess.com/rea/news/story;jsessionid=asY8VUO12L2_?id=34647

What’s Interesting about this article is that Wal-Mart, the poster child for over consumption is engaged in renewable energy to maintain it’s ability to provide consumers with aisles of garbage.

Out of the three items I purchased from Wal-Mart two of them died – a wall clock and a garlic press. The wall clock, innocently hanging over the couch, warped, almost melted from moisture or heat (I still have no idea how it happened), and the garlic press exploded because the clove of garlic I was squashing was too tough. Anyway I did purchase a 31” screen TV from them in 1999. OK, flog me now! I haven't purchased anything since, and the TV has lasted many a Laker game.

Wal-Mart should almost be commended for their new program. It’s impressive actually. But Wal-Mart taking in renewable energy to drive the engine of consumption is like Michael Jackson becoming a child psychologist.

What do you think?

ALSO!

Chevron Recognizes Energy Depletion

http://www.willyoujoinus.com/discussion/

In one giant ad that appeared Tuesday in The Wall Street Journal, Chevron states: "It took us 125 years to use the first trillion barrels of oil. We'll use the next trillion in 30."

That's a profound statement coming from a major oil company!

The end of oil is just 30 years away? How does an industrialized world function without oil? Unless a viable alternative is conceived, it doesn't. That's the point Chevron and websites like this are trying to make. In that same ad, Chevron Chairman David J. O'Reilly says the era of easy oil is over and that political, economic and physical barriers are preventing the exploitation of newfound supplies.

Some day the world will run out of oil. No one knows for sure when that day will come. But the fact that Chevron, the nation's second-largest oil company, is using this kind of language in a global campaign indicates that the day may come sooner rather than later.

However, after we hit a supply peak in oil, we will begin to see higher prices at the pump and government incentives for commuters to conserve fuel use. By this time we will realize that the official age of peak oil is upon us. I predict by 2009.

As O'Reilly puts it, "What we all do next will determine how well we meet the energy needs of the entire world in this century and beyond."

What do you think?

Monday, July 25, 2005

The Enron of OPEC

In the first article I briefly discussed how there is little transparency with regard to reliable numbers on oil stocks. This article does a good job in discussing organizations fudging their numbers to protect their interests - in this case, Saudi oil. But as the fall of Enron affected thousands, the potential slide of Saudi oil will affect millions.

By Kurt Cobb

Recently, I watched a screening of "Enron: The Smartest Guys in the Room," a documentary about the Enron scandal and collapse. But, having just completed Matthew Simmons' "Twilight in the Desert," I couldn't help thinking about the world's largest oil company, Saudi Aramco, the national oil company of Saudi Arabia. In the case of Enron Wall Street analysts were almost unanimously too polite to ask the company to show them one crucial thing: how the company made its money. The analysts admitted that Enron was a "black box" and that they just had to take company revenues and earnings on faith. As long as the stock was rising, few people questioned what was going on at Enron.

Like their Wall Street counterparts, energy analysts seem to regard Saudi Aramco as a "black box" whose claims must be taken on faith. The company frequently says it can reach 15 million barrels per day in oil production and maintain that level for 50 years. The proof they offer: "Trust us!" In fact, there has been virtually no independent information about oil in Saudi Arabia since the early 1980s with one important exception: technical papers on file with the Society of Petroleum Engineers. These papers form the basis of Simmons' book, and they cast considerable doubt on claims by the Saudis that they will be able to sustain continuing high production levels for decades.

In the case of Enron the obfuscation and deception appeared on the surface to be part of a conscious strategy to increase the stock price. That meant 10s of millions of dollars for the top managers who sold out before the company collapsed. What motive could Aramco officials have for deceiving the world about its ability to produce oil? Aramco is not a publicly traded company, and so, greedy managers looking to cash in their stock options is not an explanation. However, Saudi Arabia would surely forfeit its premiere position among the world's oil producers if oil experts suspected that Saudi supplies were about to go into decline.

But, all this assumes a conscious strategy of deception. There may be something more troubling at work. As the Enron documentary illustrated, there were many employees--even in top management--who for a long time believed that the company would succeed. That is, they believed their own hype. Could it be that Saudi Aramco officials believe their own hype? After all, the company has been the world's leading producer of oil and has a reputation for cutting edge technology and talented management. And, it has a chorus of cheerleaders from the outside. Among them is perhaps the world's most well-informed oil supply expert, Thomas Ahlbrandt, the head of the U. S. Geological Survey's World Petroleum Assessment, the most thorough study of worldwide oil supplies ever undertaken. I had a conversation with Ahlbrandt last year. He said he worked in Saudi Arabia extensively as a petroleum geologist before joining the USGS and knew the Saudis well. He believes they have the oil they say they do.

With an endorsement like that why should any of the world's energy analysts doubt Saudi Aramco? And, yet the same phenomenon occurred with Wall Street analysts who almost unanimously agreed that Enron was the next big thing. If so many influential analysts knew that Enron was a sound investment, then there appeared to be no need for the kind of scrutiny that other lesser known companies might require.

Perhaps the most disquieting possibility this analogy points to is the rapid decline of Saudi oil supplies. Saudi Aramco has been using the most advanced recovery techniques in the industry for years. While these techniques have been able to maintain high rates of production, those rates may have come with a cost. In "Twilight in the Desert" Simmons says that the history of other giant oilfields subjected to the latest oil recovery technology--he cites the case of the North Sea oilfields--shows that once decline sets in it can be rapid. North Sea production in the British sector is down more than 30 percent since the peak in 1999.

And, so it was with Enron. When the decline came, it was sudden, catching most of the investment community by surprise. Enron had a huge public following and the confidence of virtually everyone on Wall Street practically right up to the end. It was conventional wisdom that Enron could only get bigger and better.

With Saudi Aramco, is it a case of self-deception or conscious bluff? In fact, it may be a little of both. The company has pulled off heroic feats of production in the past. Perhaps these past successes make Aramco officials and the company's outside cheerleaders believe Aramco can recreate the Saudi oil miracle all over again. But, there must be some conscious bluffing in the company's approach as well. Once Aramco learned that Simmons was writing a book critical of its cornucopian claims, it began a public relations campaign to reassure the world that Aramco can supply a large part of our future petroleum needs. (A recent sample of that campaign can be found here. It has the quality of a political campaign based more on endless repetition than actual information.) But, Aramco has released very little new information in the process of this campaign. The company is essentially reiterating its "trust us" message, albeit dressed up a little more formally. (Large downward reserve revisions by Shell last year have now made "trust us" a less credible message.)

All the Saudis would have to do to refute Simmons and other critics is to release detailed oilfield data and allow independent audits. So far, they have refused, and no one expects them to change their minds.

Draw your own conclusions.

Thursday, July 21, 2005

Air Car Presentation for the UK Market

One of the many challenges of today's society is maintaining our lifestyle with minimal repercussions to the environment. This is why Guy Nègre has invented a "zero pollution" car which involves no combustion.

The MDI car can reach a speed of 68 mph and has a road coverage of roughly 124 miles -some 8 hours of travel- which is more than double the road coverage of an electric car. When recharging the tank, the car needs to be connected to the mains (220V) for 3 to 4 hours or attached to an air pump in a petrol station for only 2 minutes.Economy and the ecological benefits are the main advantages for the client since the car´s maintenance cost is 10 times less than that of a petrol-run car, costing 1 pound for the car to travel for up to 8 hours or to cover 124 miles in an Urban area.

How does it work?

90m3 of compressed air is stored in fibre tanks. The expansion of this air pushes the pistons and creates movement. The atmospheric temperature is used to re-heat the engine and increase the road coverage. The air conditioning system makes use of the expelled cold air. Due to the absence of combustion and the fact there is no pollution, the oil change is only necessary every 31.000 miles.At the moment, four models have been made: a car, a taxi (5 passengers), a Pick-Up truck and a van. The final selling price will be approximately 5.500 pounds.

The Company"Moteur Development International" (MDI) is a company founded in Luxembourg, based in the south of France and with its Commercial Office in Barcelona. MDI has researched and developed the Air Car over 10 years and the technology is protected by more than 30 International patents.MDI´s expansion has just begun and they have already signed 50 factories in Europe, America and Asia.

The company is offering 20 licences in the UK as exclusive manufacturing areas for cars as well as offering other licences in the nautical and public transport sectors.The Factory It is predicted that the factory will produce 3.000 cars each year, with 70 staff working only one 8-hour shift a day. If there were 3 shifts some 9.000 cars could be produced a year.MDI is undertaking a long-term franchise business. The graphs show an important profit margin, which will be increased by the subsequent exclusive spare-parts market.

You can find more information on the Web page: www.theaircar.com or telephone +34 93 362 37 00

www.theaircar.com (English)

www.motordeaire.com (Spanish)

www.motormdi.com (Portuguese)

Wednesday, July 13, 2005

Peak Oil Awareness: A Quick Intro

Peak Oil:

An Introduction for Further Exploration

(No Pun Intended)

The intent of this post is not to frighten or to claim the sky is falling, rather it is meant to inform you that, within our lifetime, our world will change significantly. Those who are prepared will fair better than those who are not.

I will present the problem and include some links for discussion, but it is up to us to find solutions and educate ourselves, and others. Try to find your own solutions, and please fell free to post. Remember to be courteous of others while posting.

(What flows is a culmination of information I have collected while researching the topic. The numbers are collected from various sources. You can verify by checking the links at the bottom of the page and engaging in your own fact-finding.)

Philosophical

Successful people like Donald Trump, Bill Gates, Bill Clinton, and Oprah Winfrey plan and prepare for the future. They are prepared because they study their world, follow their passions, and execute their plan. How many people in the world do the same? Do you have a long-term plan on paper, and are you executing that plan daily? Do you have your own personal mission statement? Most people don’t. This is because most of us were not taught how to plan long term. In High School and College we were taught how to be employees and follow someone else’s plan – your boss’s or your company’s plan.

Coupled with societies highly placed value on the type of vehicle one drives, the style of clothes one wears, and the size of house one lives in, it’s easy to see how people may become distracted. So as material possessions are accumulated, energy is spent paying off such items usually at the expense of other things. People often become too focused on working hard to pay off bills, and they may loose site of events around them.

What’s the point?

What I’m getting at is we may need to take some time out of the rat race to educate ourselves as to where our world is going, devise plans, and educate others. But it starts with you, the individual, and extends to others. Events such as 9-11, the Iraqi invasion, the proliferation of global violence, the recent attacks in London etc. are clear signs that things are getting shaken up and that change is on our doorsteps. Some say the global system is “adapting”, but it’s only adapting as quickly as the global influencers have decided.

Such events should serve as clues, but they seem to distract the public instead. The London bombings upstaged the record oil price of $62.10 which immediately preceded them, and they caused investors to anticipate demand destruction, which dropped the price back down. Also China is attempting to buy an American oil company called Unocal. Quite apart from the actual price, the bombings also re-imbued the world's energy issues with deeply irrational emotions of revenge and horror that might prevent civilians from reaching their own more rational conclusions as to the causes of high energy prices - and the underlying dangers posed by what more and more people recognize as Peak Oil.

As Donald Rumsfeld would say, “As we know, There are known knowns. There are things we know we know. We also know there are known unknowns. That is to say we know there are some things we do not know. But there are also unknown unknowns, the ones we don't know we don't know.” —Feb. 12, 2002, Department of Defense news briefing

I think what Rummy was attempting to explain is that you can prepare for the future based on empirical evidence, however there is always the chance of an “unforeseen” event.

Here’s what we do know. Oil resources are running out, international violence is spreading, and Peak Oil theory is gaining credibility. The reason peak oil is a “theory” is that oil companies attempt to disguise facts and often inflate their numbers to solidify their stock. However, oil is being consumed faster than it can be produced, and people are catching on. It normally takes millions of years for carbon based life forms to decay and turn into oil, so we can’t rely too much on nature to bail out our decreasing supply.

Mainstream news agencies are waking up to the notion of peak oil. (You can read on and check the links later)

BBC:

http://news.bbc.co.uk/1/hi/business/4077802.stm

NPR:

http://www.npr.org/templates/story/story.php?storyId=3870191

National Geographic:

http://magma.nationalgeographic.com/ngm/0406/feature5/

News Week:

http://msnbc.msn.com/id/4287300/

Some Raw Numbers

Today oil supplies about 50% of the world’s energy and 96% of its transportation energy. Since the shift from coal to oil, the world has consumed over 875 billion barrels. Another 1,000 billion barrels of proved and probable reserves remain to be recovered. No other energy source comes close to oil’s convenience, power, and efficiency. From now to 2020, world oil consumption will rise by about 60%. Transportation will be the fastest growing oil-consuming sector. By 2025, the number of cars will increase to well over 1.25 billion from approximately 700 million today. Global consumption of gasoline could double.

The two countries with the highest rate of growth in oil use are China and India, whose combined populations account for a third of humanity. In the next two decades, China's oil consumption is expected to grow at a rate of 7.5% per year and India’s 5.5%. (Compare to a 1% growth for the industrialized countries). It will be strategically imperative for these countries to secure their access to oil - whoever gets to the oil first will ensure their economy can sustain growth for the short term at least.

Oil prices have recently risen by about $25 per barrel, America's annual oil-import bill rose about $75 billion per year (about $250/person). This is a classic economics 101 formula – as supply decreases, demand increases, price increases. We will never see “cheap” oil again.

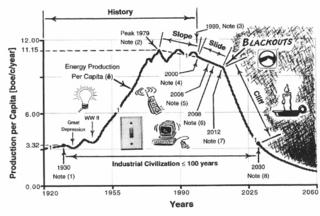

The global decline of oil discoveries began around 1964. According to BP-Amoco, world oil production per capita peaked in 1979. This figure is confirmed with the International Energy Agency (IEA). So don’t expect any new, enormous oil field discoveries.

Notable Quote

In April 2001 the Council on Foreign Relations and James A. Baker, HW Bush’s former Secretary of State, published a detailed study of world energy problems. He claims:

“Strong economic growth across the globe and new global demands for more energy have meant the end of sustainable surplus capacity in hydrocarbon fuels and the beginning of capacity limitations. In fact, the world is precariously close to utilizing all of its available global oil production capacity, raising the chance of an oil supply crisis with more substantial consequences than seen in three decades.

These choices will affect other US policy objectives: US policy towards the Middle East; US policy toward the former Soviet Union and China; the fight against international terrorism.Meanwhile, across much of the developing world, energy infrastructure is being severely tested by expanding material demands of a growing middle class, especially in the high-growth, high-population economies of Asia. As demand growth collide with supply and capacity limits at the end of the last century, prices rose across the energy spectrum, at home and abroad.”

What Does the Future Hold?

Oil is the main catalyst for growth in this modern industrial era. Without it such growth is impossible. There is no other energy source (nuclear – very costly and dangerous, solar, wind, water) that even comes close to the power and efficiency oil provides.

Several sources are claiming that an oil crash should occur around the year 2012, which coincides with economic analysts report that we will hit a major recession starting around 2009-2010. Whether the two are linked I am not sure, but the information is compelling.

(See chart below, for illustration purposes, sorry it's fuzy...the dip hits 2012 - blackouts)

So how will that impact us aside from higher costs at the pump? Not only is oil valuable for gasoline and motor oil, but also oil is the critical ingredient to most of the items sold and consumed by modern society. To gain an added perception to the importance of oil: Over 500,000 products including electricity, fertilizers, medicines, lubricants, plastics (computers, phones, shower curtains, disposables, toys, etc.), asphalt (roads and roofs), insulation, glues/paints/caulking, (modern synthetic rubber) tires and boots, asphalt, carpets, synthetic fabrics/clothing, stockings, insect repellent are made from oil.

If the price of oil goes up, every downstream use is affected.

The younger generations of India, China and South East Asia are more educated, desire consumer goods, and vehicles. Demand is increasing globally and more oil resources are needed to meet that demand.

Food

Oil is extremely critical to our food supply. Modern food production consumes ten calories of energy for every calorie contained in the food. When the farmer goes out to plant seeds, she drives a vehicle powered by oil. After planting she sprays the crops with fertilizers made from ammonia, which comes from natural gas (natural gas reserves are also finite). Then she sprays crops several times with pesticides made from oil using another piece of machinery that consumes oil. She irrigates the crops with water that most likely has also been pumped by electricity generated by coal, oil, or gas. Oil powers the harvest, transportation to processing plant, processing refrigeration, and transport to the grocery store (to which you, the consumer, drive an oil-powered vehicle). You may pay for the food with your credit card made from oil. The credit card terminal where you swipe your card and the cash register where your receipt is printed – yes, made from oil. Also the cutting down of a tree provided you with the receipt, the bleaching of the paper, were made possible by oil. Then you take your food home, cook it by means of either electricity or natural gas, and eat it on a plate that may have been made from oil, after which you wash the plate with a synthetic sponge that is also made of oil.

What will oil shortages do to our food supply?

The countries that are unable to have access to oil will be devastated by famine. Put it this way. If the fertilizers, partial irrigation, and pesticides were withdrawn, corn yields for example, would drop from about 130 bushels per acre to about 30 bushels. The same applies in varying degrees to any crop: alfalfa, lettuce, celery, onions, tomatoes; anything that commercial agriculture produces.

Beef products will be affected as well. Cattle, pigs, and chicken feed on grain and corn, so the price of beef will be affected and fast food restaurants will be forced to raise their prices.

Customer - “I’ll take a number 2, super sized please.”

Attendant – “Thank you, your total is $35, please pull up to the first window”

Conclusions

From what I have read some assess that a severe economic crash and global famine will destroy modern society as we know it. Martial law will take place, people will arm themselves, and those who argue this notion point to the Patriot Act and declining civil liberties as a taste of what’s to come – a police state. Let’s ID everyone, even illegal aliens… The earth cannot sustain the numbers of humans and natural order will force down populations once humans have exceeded resource limitations. Humans will be forced to revert back to simpler living.

Others have said that we can avoid such a catastrophe by creating a plan as soon as possible. Some people are already growing their own food in their back yards. http://www.pathtofreedom.com/aboutus.shtml. It’s possible we may see local/community farming make a comeback.

My personal assessment, and this is as rosy as I can get, is that the United States will have consolidated enough Middle Eastern oil to give the country a few extra years of cheaper oil, so alternative innovation can take hold. The trick will be to hold on to that oil when hungry people come knocking. Global populations will decrease. We’ll have economic convulsions as we attempt to kick the oil habit, like a drug addict kicking his/her dependency, ushering in a severe recession (Some fear the recession will be similar to that of the Great Depression) – they come in cycles and we are over due. The industrial areas will be hit hard.

America’s free enterprise system, the employed segment of it, shuold be able to adapt as alternative fuel sources arise, and society may have to implement solar, wind and other forms of energy all at once. George Bush recently advanced the notion of building additional nuclear plants, and some environmentalists are actually on board with that idea, but the risks are high and it takes decades before a nuclear plant pays for itself. “Not since 1973 has an order been placed for a new reactor. Two events helped end, for a time, any U.S. interest in reactors beyond those already under construction: the partial meltdown at Three Mile Island nuclear plant in Pennsylvania in 1979 and the 1986 explosion at the Chernobyl plant in the Ukraine.” http://www.usatoday.com/news/washington/2005-06-22-bush_x.htm?csp=34

To say that there is “no reason to fear” or “someone will take care of us” or “the government will think of something” or “the media will shake things up” would be naïve. We cannot rely on others to dictate our destinies. But like John F. Kennedy’s over used, yet effective quote states, “The only thing to fear is fear itself”. Before we can act upon an issue, we need to recognize the problem. We need to educate ourselves, and others to the realities of Peak Oil.

Please forward this to others.

What do you think? Comments are below.

If you find good articles or web sites on your own, please email me the link momagic72@hotmail.com

Check out the links on the upper left to get you started:

You can also Google “Peak Oil” “Oil Crash” etc. Don’t rely on the mainstream media.

HIGHLY RECOMMEND

The food portion of this article was composed using information from:

“Crossing the Rubicon: The Decline of the American Empire at the End of the Age of Oil” by Michael Ruppert. http://www.fromthewilderness.com/

(Check out the maps at the bottom of this link) http://www.fromthewilderness.com/free/ww3/012505_ftw_maps.shtml

Richard Heinberg, The Party's Over: Oil, War, and the Fate of Inudstrial Societies; Powerdown: Options and Actions for a Post-Carbon World, and

A special thanks to all those people who have done the research and who have posted these very informative sites.