Wednesday, March 28, 2007

Bush Interference with Climate Change Science

The Government Accountability Project, a whistleblower and watchdog group in DC, released a report (.pdf) today detailing a top-down government campaign to suppress climate change research that deviated from policy positions within the Bush administration. In particular, the administration tried to bury research that showed human activity contributes to global warming and stronger storms.

The GAP report, "Redacting the Science of Climate Change," took a year to assemble and relies on information from dozens of interviews and thousands of FOIA disclosures, internal documents and public records. It illustrates an organized and secretive White House effort beginning in 2001 to restrict scientists' ability to accurately communicate their research results to the media, the public and Congress. Using low-level proxies, the administration altered press releases, muzzled scientists who spoke openly and, frequently, routed requests for information about sensitive research to the White House. In the report, GAP focuses on NOAA but includes information on similar tampering at NASA and the EPA.

Although evidence of the Bush administration playing politics with climate change science has trickled out in the media for some time, the GAP report collects and synthesizes many of the more egregious offenses. Tarek Maassarani, the report's author, will testify later today in front of a House Science Committee hearing on political interference in science research (check back here for more this afternoon).

In recent months, the White House, facing a backlash over its heavy handed treatment of government scientists, has claimed that it always supported the view that global warming is real and humans contribute to the problem. President Bush has also morphed into an ethanol fiend, popping up at seven photo ops already this year, sometimes in a white lab coat, to pump corn fuel. When he ran for president, Bush mocked hybrid vehicles.

Wednesday, March 21, 2007

E-Waste - 40 Million Tons/Year

Also lasts week, a global public-private partnership was launched to reduce the nearly 40 million tons of e-waste produced globally each year that ends up in China, India, and other developing countries. The goals of the initiative, called Solving the E-Waste Problem (StEP), is to standardize e-waste recycling processes globally, extend the life of products and markets for their reuse, and harmonize world legislative and policy approaches on e-waste.

http://www.greenbiz.com/news/news_third.cfm?NewsID=34715

Wednesday, February 28, 2007

Scientists Offer Climate Plan to U.N.

UNITED NATIONS (AP) - To head off the worst of climate change, governments must pour tens of billions of dollars more than they are into clean-energy research and enforce sharp rollbacks in fossil-fuel emissions, an expert scientific panel reported to the United Nations on Tuesday.

The U.N. itself must better prepare to help tens of millions of "environmental refugees," the group said, and authorities everywhere should discourage new building on land less than one meter - 39 inches - above sea level.

The 166-page report, two years in the making, forecasts a turbulent 21st century of rising seas, spreading drought and disease, weather extremes, and damage to farming, forests, fisheries and other economic areas.

"The challenge of halting climate change is one to which civilization must rise," said the panel of 18 scientists from 11 nations, whose work was conducted at U.N. request and sponsored by the private United Nations Foundation and the Sigma Xi Scientific Research Society.

Their dozens of recommendations about what to do to mitigate and adapt to global warming come just three weeks after the Intergovernmental Panel on Climate Change (IPCC), an authoritative U.N. network of 2,000 scientists, made headlines with its latest assessment of climate science.

The IPCC expressed its greatest confidence yet that global warming is being caused largely by the accumulation of carbon dioxide and other heat-trapping gases in the atmosphere, mostly from man's burning of coal, oil and other fossil fuels. If nothing's done, it said, global temperatures could rise as much as 11 degrees by 2100.

Temperatures rose an average 1.3 degrees over the past 100 years. The scientists who produced Tuesday's report said further rises this century should be limited to about 3.6 degrees, or the world risks crossing a climate "tipping point" that could produce "intolerable impacts on human well-being."

They said global carbon dioxide emissions should be leveled off by 2015-2020, and then cut back to less than one-third that level by 2100 - via a vast transformation of global energy systems, toward greater efficiency, away from fossil fuels and toward biofuels, solar and wind energy and other renewable sources of energy.

That changeover would be spurred by heavy "carbon taxes" or "cap-and-trade" systems, whereby industries' emissions are capped by governments, and more efficient companies can sell unused allowances to less efficient ones.

Such schemes - already in use in Europe under the Kyoto Protocol climate pact - have been proposed in Congress, but are opposed by the Bush administration, which rejects Kyoto.

The White House points to spending of almost $3 billion a year on energy-technology research as its major contribution to combatting climate change. But the U.N. experts panel said such research worldwide is badly underfunded, and requires a tripling or quadrupling of spending, to $45 billion or $60 billion a year.

Specialists say governments particularly should step up research into carbon capture and sequestration - technology to capture carbon dioxide in power-plant emissions and store it underground or underwater. In fact, the experts panel urged governments to immediately ban all new coal-fired power plants except those designed for eventual retrofitting of sequestration technology.

Among its wide-ranging list of recommendations, Tuesday's report also called on U.N. agencies to study the need for an internationally accepted definition of "environmental refugee," since treaties recognize only political refugees as eligible for aid from the U.N. refugee agency.

The report expressed "special concern" that international capacity could be overwhelmed by coastal refugees fleeing seas rising as they expand from heat and melted land ice. Scientists estimate a sea-level rise of one meter, or 39 inches, by 2100 - conceivable in IPCC projections - would displace roughly 130 million people worldwide.

The U.N. panel was led by biodiversity expert Peter H. Raven, Missouri Botanical Garden director and past president of Sigma Xi, and University of Michigan ecologist Rosina Bierbaum.

---

On the Web: http://www.unfoundation.org/staging/seg/

Thursday, January 25, 2007

U.N. climate report will shock the world

"There are a lot of signs and evidence in this report which clearly establish not only the fact that climate change is taking place, but also that it really is human activity that is influencing that change," R.K. Pachauri, the IPCC chairman, told Reuters.The report by the Intergovernmental Panel on Climate Change (IPCC), due for release on Feb. 2 in Paris, draws on research by 2,500 scientists from more than 130 countries and has taken six years to compile.

"I hope this report will shock people, governments into taking more serious action as you really can't get a more authentic and a more credible piece of scientific work. So I hope this will be taken for what it's worth." The IPCC will say it is at least 90 percent sure than human activities, led by the burning of fossil fuels, are to blame for global warming over the past 50 years, sources say.

The new report is likely to foresee a rise in temperatures of 2 to 4.5 Celcius (3.6-8.1 Fahrenheit) this century, with about 3 Celcius (5.4F) most likely. FREAK WEATHER Pachauri told Reuters in an interview the findings of the report, which is the fourth of its kind, will be "far more serious and much more a matter of concern" than previous reports.There is more evidence around the world that greenhouse emissions are causing temperature increases, sea level rises, the melting of glaciers, freak weather phenomena and the problems of water availability, said Pachauri.

"For example, the Arctic is clearly melting at faster rates than other regions of the world," he said. "The figures are in the report and it is much faster than what was anticipated." "The impacts are clearly very serious for some vulnerable parts of the world. Small island states are clearly very vulnerable and parts of South Asia are vulnerable in respect of droughts and floods and also the melting of the glaciers."

Pachauri, also director of India's top environment centre, the Energy and Research Institute, said there was more awareness of climate change around the world today than ever before and applauded Europe and Japan for their efforts. He said scepticism about the linkages between human activities and climate change was dwindling as more evidence came to light. "I think the sceptics on climate change will continue, but the good news is that their numbers and their effectiveness is on the decline," Pachauri said.

"The gaps in knowledge will always be there in science but you use your judgement and that's what good policy is all about ... If you take action, the benefit is that you might actually be minimising the harmful impacts of global warming."

Wednesday, January 17, 2007

Evangelical, Scientific Leaders Unite

Ron Brynaert

Published: Wednesday January 17, 2007

A unique partnership was introduced at a Washington news conference today, as a dozen evangelical and scientific leaders announced a new joint effort to protect the environment and defend "life on earth," according to a press release received by RAW STORY.

A unique partnership was introduced at a Washington news conference today, as a dozen evangelical and scientific leaders announced a new joint effort to protect the environment and defend "life on earth," according to a press release received by RAW STORY.

The coalition's leaders "shared concerns about human-caused threats to Creation -- including climate change, habitat destruction, pollution, species extinction, the spread of human infectious diseases, and other dangers to the well-being of societies."

An "Urgent Call to Action" statement signed by twenty-eight members of the coalition was sent off to President George W. Bush, House Speaker Nancy Pelosi, congressional leaders from both parties, and national evangelical and scientific organizations, urging "fundamental change in values, lifestyles, and public policies required to address these worsening problems before it is too late."

"Business as usual cannot continue yet one more day," the statement declares.

Pledging to "work together toward a responsible care for Creation and call with one voice," the group is appealing "to the religious, scientific, business, political and educational arenas to join them in this historic initiative."

"There is no such thing as a Republican or Democrat, a liberal or conservative, a religious or secular environment," Nobel laureate Dr. Eric Chivian, Director of the Center for Health and the Global Environment at Harvard Medical School, said in the statement. "We all breathe the same air and drink the same water. Scientists and evangelicals share a deep moral commitment to preserve this precious gift we have all been given."

Rev. Richard Cizik, Vice President for Governmental Affairs of the National Association of Evangelicals, added, "Great scientists are people of imagination. So are people of great faith. We dare to imagine a world in which science and religion cooperate, minimizing our differences about how Creation got started, to work together to reverse its degradation. We will not allow it to be progressively destroyed by human folly."

The coalition hopes to meet with bipartisan Congressional leaders "to inform them of this unprecedented effort and encourage their attention to environmental issues." A "Summit on the Creation" is also planned, as well as "outreach tools, such as a Creation Care Bible study guide and environmental curricula."

"Love of God, love of neighbor, and the demands of stewardship are more than enough reason for evangelical Christians to respond to the climate change problem with moral passion and concrete action," the group states.

National Public Radio has a pdf of the evangelical "Call to Action" which can be accessed at this link.

Wednesday, January 10, 2007

EU plans 'industrial revolution'

The European Commission has urged its members to sign up to an unprecedented common energy policy, unveiling a plan to diversify the bloc's energy sources.

The European Commission has urged its members to sign up to an unprecedented common energy policy, unveiling a plan to diversify the bloc's energy sources. The EU wants a radical shift towards renewable energy |

But political as well as environmental concerns should spur change, he noted.

EU vulnerability as an oil importer was thrown into sharp relief this week when Russia's row with Belarus hit supplies.

Binding targets

This is the first step towards a common energy policy, says the BBC's Europe editor Mark Mardell.

There are three central pillars to the proposed integrated EU energy policy.

- A true internal energy market

- Accelerating the shift to low-carbon energy

- Energy efficiency through the 20% target by 2020

![]()

![]()

In addition to the 20% of all EU energy that should come from renewable power by 2020, 10% of vehicle fuel should come from biofuels, said EU energy chief Andris Piebalgs.

The EU wants to make these targets to be binding for the first time, he said.

It also wants to make sure all new power stations are carbon neutral in 13 years - they should be built in such a way that carbon can be captured and buried - as well as ensuring there is a big increase in renewable power like wind and wave energy.

"We need new policies to face a new reality - policies which maintain Europe's competitiveness, protect our environment and make our energy supplies more secure," said Mr Barroso.

"Europe must lead the world into a new, or maybe one should say post-industrial revolution - the development of a low-carbon economy."

Without such investment and energy efficiency measures, the EU report predicts that EU energy imports will rise from 50% of consumption to 65% by 2030, requiring increased reliance on potentially unpredictable sources.

Internal market

Although energy has been a driving factor of the EU, which was born as the European Coal and Steel Community in 1951, policy has on the whole remained a national issue.

The EU wants to fully open up the existing energy market to enable half a billion citizens to get their electricity or gas from anywhere else in Europe.

Mr Barroso proposed stopping power generation and power supply being owned by the same company, which is very controversial in France and Germany.

"We have two points of disagreement with the commission, which are the possible eventual abolition of controlled prices and the question of separating asset ownership by integrated operators," AFP cited an official source at the French industry ministry as saying.

Meanwhile the commission's proposal to reduce emissions was lambasted by one environmental pressure group.

"If the EU is serious about tackling climate change it must make far greater cuts in its carbon dioxide emissions. The proposed 20% cut does not demonstrate any intention to stay below the two degree limit," Catherine Pearce, the group's international climate co-ordinator, said.

The package of measures will have to be approved by European governments before it can come into force.

EU leaders will debate the commission's proposals at a summit in March.

Wednesday, November 29, 2006

Supreme Court battle considers regulation of greenhouse gases

By Michael Doyle

McClatchy Newspapers

(MCT)

WASHINGTON - The Supreme Court's hottest environmental case of the year pits California against Texas.

It's also Washington state vs. Idaho, scientists vs. car dealers and, it may seem, the world against the White House, as the justices on Wednesday consider a crucial question in the effort to combat global warming.

The question is this: Can the federal government regulate the so-called greenhouse gases many experts blame for rising global temperatures? The Bush administration says no. California, Massachusetts, Washington, 15 other states and their allies insist otherwise. The final answer is now up to the court's nine justices.

"This is a global problem," California Secretary for Environmental Protection Linda Adams said Tuesday, "and I think everyone agrees that a global problem needs a global solution."

The high stakes in Wednesday's hour-long oral arguments will be drawing plenty of courtroom kibitzers. Already, groups ranging from Alaskan tribes to the National Automobile Dealers Association have staked out sides.

The decision could be cast very narrowly next year. Or it could spur officials trying to cut the roughly 500 million tons of carbon dioxide emitted annually by U.S. cars, trucks and other vehicles.

"A favorable ruling would reinforce our authority to move forward on regulations," Adams said.

California wants federal approval for setting strict new emissions standards on cars and light trucks. The state's federal waiver request may be bolstered by the court's eventual ruling in the case formally known as Massachusetts v. Environmental Protection Agency. California is also moving ahead unilaterally in controlling stationary sources of greenhouse gases.

Neither side disputes that the Earth is getting hotter. The Earth's average surface temperature is now warming at the rate of about 3.2 degrees Fahrenheit per century, according to the National Oceanic and Atmospheric Administration. The 10 warmest years in the past century have all taken place since 1990.

The law and the politics are trickier. So is some of the science.

The Bush administration stresses in legal briefs the "substantial debate and uncertainties" surrounding cause and effect. Prominent climate scientists including David Battisti and John M. Wallace from the University of Washington retort that all reasonable doubt has evaporated.

"Time is of the essence, because delay in greenhouse gas regulation will only accelerate global climate change," Battisti and Wallace argue in legal filings.

In 1999, environmentalists petitioned the EPA to regulate the carbon dioxide emitted from new cars and trucks. Carbon dioxide is one of the gases thought to trap the Earth's heat.

The Bush administration refused. After weighing some 50,000 public comments, the EPA concluded that the Clean Air Act doesn't give it the authority to regulate greenhouse gases.

"The only provisions of the Act that specifically mention carbon dioxide or `global warming' are expressly non-regulatory in nature," the administration argues in its legal brief.

The administration further contends that the term "air pollution" doesn't encompass global climate change. By contrast, the Clinton administration's EPA had twice concluded the Clean Air Act empowered federal officials to regulate greenhouse gases - if they wanted to.

The energy-producing states siding with the Bush administration fear the burdens of new nationwide greenhouse gas controls.

National rules "for carbon dioxide would result in states having to attain an air quality standard but lacking the power to affect many of the emission sources that are contributing to their lack of attainment," Alaska, Idaho, Texas and seven other states argue in their legal brief.

The court could punt, by ruling narrowly that states such as Massachusetts and California lack the legal standing to sue. The Bush administration proposes this option as a first line of attack, arguing that the states can't prove they have suffered harm from the EPA's refusal to regulate.

Alternatively, the court could forthrightly answer whether the EPA can regulate greenhouse gases. Even a "yes" answer, though, wouldn't specify what those regulations must look like.

Friday, November 17, 2006

Stop Junk Mail, Clean up Environment

According to the GreenDimes (http://www.greendimes.com/index.html?src=mkt&partner=idealbite1106) school of thought. The concept is simple: for a dime a day, the company will stop your paper junk mail and plant a tree for you each month. So, for the cost of fishing between your couch cushions every once in a while, you get the pleasure of avoiding paper spam while making the air and waterways a little cleaner for all of us. Considering that collectively in the US, one year's junk mail could fill 420,000 dump trucks, it's worth collecting those dimes.

GreenDimes head honcho Pankaj Shah hates junk mail (like you Biters). The day he received two different credit card offers from the same company, enough was enough... he took matters into his own hands and started GreenDimes. The company's service is unique because they continually contact direct mail companies to make sure you stay off their lists. "Combining social good and capitalism has been on my mind for years," says Shah. "This is about more than junk mail, it's about helping people take control of their environmental footprint in a measurable way." Judging by the numbers, it's already working, with over 3,000 lbs of junk mail stopped in GreenDimes' first month of operation.

- In its first month, GreenDimes stopped 3,220 lbs of junk mail and saved 11,272 gallons of water.

- In that same month, the company planted more than 4,000 trees with the non-profit Trees for the Future.

- Protects your identity. Getting off junk mail lists reduces the chances of someone stealing it.

- Contacts more direct mail companies than other services, making sure you'll receive a lot fewer catalog and credit card offers.

- Saves you the hassle of doing it yourself.

- Uses recycled paper at their HQ.

- Their gift memberships make prime holiday presents.

Since new direct mail companies are popping up all the time, junk mail can sometimes slip through (and researching how to stop it can take time). Additionally, political mailers aren't blocked, and as we saw from last week's election, those can get pretty overwhelming.

Thursday, November 09, 2006

Bush’s Chernobyl economy; hard times are on the way

Strong investment areas for the next ten years:

Commodity stocks - oil, silver, gold etc.

Chinese and Indians, Chindians, have booming populations, increasing middle class, and a higher demand for consumer products. Resources are required to create more goods, and to build infrastructure. Business will be good for metal mines.

Real Estate - Although, don't buy overvalued property

The US population will continue to grow and people will always require housing.

Alternative energy/Green technology stocks

As oil and gas prices continue to increase, alternative technologies will be en vogue. Don't assume the latest drop in oil prices will be the norm.

ARTICLE

***********************************************************

Bush’s Chernobyl economy; hard times are on the way

By Mike Whitney

Online Journal Contributing Writer

In the next few months, a financial crisis will arise somewhere in the world which will jolt the American economy and trigger a swift and precipitous decline in the value of the dollar.

This is not speculation; it will happen and there is nothing that the Bush administration can do to stop it.

All of the traditional supports for the dollar have been removed by a shrinking economy, a massive $800 billion account deficit, dramatic increases in the money supply, and the reckless manipulation of interest rates.

Now, the noose is tightening. Our foreign trading partners can see that we are bobbing in an ocean of red ink and are refusing to buy back our debt in the form of US Treasuries. This is a death sentence for the dollar. It means that in a matter of months the once-mighty greenback will crash through the floor and free-fall through open space.

Mike Swanson of the WallStreetWindow explains the worrisome details related to last month’s trade deficit, “Just a few days ago the US Treasury reported that the net capital inflows from the rest of the world into the US fell for a 6th month in a row. Private from abroad fell to $34.7 billion in August and from $72.9 billion in July. Asian central banks made up for the shortfall. If they hadn’t the current account deficit would have exploded. The NY Times quoted Ashraf Laidi, a currency analyst at MG Financial Group as saying, 'foreign central banks saved the dollar from disaster. The stability of the bond market is at thee mercy of Asian purchases of US Treasuries.'”

Swanson poses an interesting theory, but it can’t be verified since the Fed stopped printing the M-3 that would provide the relevant facts about the current cash inflows.

Jim Willie of GoldenJackass.com, offers an entirely different theory in his recent article “Spent Dollar Momentum.”

Willie opines, “Behind the scenes are the many illicit London-based firms busily buying US Treasury Bonds with freshly-printed money from the Dept of the Treasury. Their tracks are covered by the blackout on the money supply statistic. (M-3) An isolated US government with a well-oiled printing press as the primary support device makes for a dangerous currency situation.”

Willie’s theory jives nicely with the US Treasury’s figures on the “Foreign Financing of US Government Debt” (June 2006) Surprisingly, between 2005 and 2006, our friends in the United Kingdom purchased another $142 billion of USD bringing their stockpile of dollars to 201.4 billion.

Why?

Why would UK investors suddenly stock up on dollar assets when everyone else in the currency market is moaning about the greenback’s systemic problems?

Could it be that banks in the UK are just hiding the paper trail for friends in America who wanted to forestall a collapse in the dollar until after the election?

Of course there is another explanation for the irregular activity in cash inflows, (purchase of US Treasuries) that is, that we’re still living in a "faith-based" Wonderland where foreign trading partners are only too happy to buy an endless supply of worthless paper from a well-meaning giant who is busy spreading democracy to the "great unwashed" in developing world.

Of course, that is an utter fiction. The world is backing away from the dollar and dollar-based assets while the Federal Reserve attempts to conceal the details until we get through the election-cycle. It's that simple.

There is nothing accidental about the crisis we'll soon be facing. The officials at the Federal Reserve and the US Treasury are fully aware of the devastating effects of massive trade deficits, increasing the money supply, and interest rates. They have set the country on the path to ruin as part of a broader scheme for remaking the global system according to well-known precedents. In truth, the plan to modify the present system has a long history; going back to the 1980s when many of the same actors in government today were in positions of power in the Reagan administration. For the last six years they have been patching together their strategy; producing record deficits, unfunded tax cuts, mammoth government expansion, and doubling the money supply.

Who can possibly argue that they did not understand the implications of their actions?

Did Greenspan know that by lowering interest rates in 2001 to 1.5 percent that he would sluice trillions of dollars into the real estate market, producing the largest equity bubble in history? And, if he didn't know, then how is it that the Fed provides the statistics which actually tell how large the housing bubble is?

Can’t Greenspan read the charts and graphs his own organization puts out?

And why did Alan Greenspan support the “no down payment,” “interest-only” loans and adjustable rate mortgages (ARMs), which allowed “high risk” people to qualify for mortgages when the Fed knew, according to their own figures, that if interest rates went up, foreclosures would skyrocket?

Of course he knew; they all knew. How could they NOT know? They produce the facts and figures themselves! It’s all part of a madcap scheme to shift wealth to the top 1 percent and drive a wooden stake into the heart of the middle class. When Greenspan saw that doomsday was approaching, he got “cold feet” and bailed out. Now the scholarly Ben Bernanke is left to supervise the economic meltdown and face the public scorn.

Trouble Ahead

Currently, the U.S. economy is held together by the slimmest of threads; literally duct-taped together by massaging all the crucial economic numbers, pumping as much cheap fiat-currency into the system, and by "increasingly suspicious" maneuverings in the futures markets. With the elections over, there will be no reason to conceal the rot at the heart of the system. After all, we are not facing an unforeseen catastrophe, but a planned demolition intended to increase the disparity between rich and poor to such an extent that democracy, as we know it, will no longer be possible.

Nothing is more repugnant to America’s ruling elite than the notion that every man, however broke and insignificant, can participate in our system of government.

The Federal Reserve's bloody fingerprints are all over our present dilemma. The privately-owned Fed has never operated in the public interest. By doubling the money supply in the last seven years and keeping interest rates artificially low, the Fed has generated a $10 trillion housing bubble while, at the same time, ignoring a $800 billion trade deficit which is sucking up American assets and crushing American industry at an unprecedented rate.

This massive expansion of debt has increased the likelihood that an unexpected event, like a bank failure or a teetering hedge fund, will cause a major disruption in the markets, sending tremors through the global system. Even if nothing explosive happens, the faltering real estate market will continue to swoon, consumer spending will dry up, and the fragile economy will crash to earth. In fact, this is taking place right now; retail sales are anemic, residential housing dropped a whopping 17 percent in the last three months, and economic growth shrunk to a measly 1.6 percent in the third quarter. The only thing keeping the economy from collapsing entirely is the sudden drop in oil prices that “conveniently” coincided with the midterm balloting.

This won’t last. According to industry analyst Matthew Simmons the world production of oil may have already peaked, setting the stage for a leveling-off period before the inevitable decline. Simmons has data to show that “world supply of oil has declined to 83.98 million barrels per day in the second quarter after hitting 84.35 million bpd in the forth quarter of 2005.” Oil production is going backwards not forwards.

No one believes the price of oil is going down any time soon. As energy prices rise and the housing market falls; consumer spending, which added $825 billion from home equity into last year’s economy, will continue shrivel. Thus, the Fed will have to make the tough choice of whether to loosen the purse strings and lower interest rates to keep the economy sputtering along or ratchet up rates to attract more foreign investment. (Keep in mind that the real estate market is already in retreat, even though the full force of the Fed’s interest rate increases won’t be felt for up to six to 12 months after they have been raised. The worst is yet to come)

Most economists believe that Fed Chairman Bernancke will be forced to lower rates sometime in 2007 to try to stimulate the economy and to affect a “soft landing” in the housing market, but don’t count on it.

I believe the Fed is more likely to either keep rates the same or raise them to outpace the anticipated increases in Europe and Asia. The reason for this is simple: it presently takes nearly $2.5 billion per day to maintain our current account deficit. To continue to attract foreign capital, US Treasuries must offer a higher rate of return than their foreign competitors. Now that the economies in Europe and Asia are growing, their interest rates are going up accordingly (to slow inflation). That means that the only way that America can continue to expand its debt, through the exchange of fiat currency for resources and manufactured goods, is by raising the return on Treasuries. And, that is probably what Bernanke will do, even though it will skewer the struggling American worker and the US economy at the same time.

The secret to running the global economic system is to control the issuance of currency and thereby be in a position to expand one’s own debt as one sees fit. The Federal Reserve must preserve its “dollar hegemony” if it wants to maintain the greenback as the world’s “reserve currency.” To accomplish that, the dollar must stay one step ahead of its competitors (higher rates) and prove that it is on solid financial footing. This is impossible now that the US economy is contracting, so Washington has decided to do the next best thing; corner the oil market. By controlling Middle East oil, US policy-makers believe that they can force foreign nations to accept the debt-plagued greenback regardless of the faltering US economy. It is no different than any other extortion racket.

If the plan succeeds the dollar will remain the de facto international currency. But it is a difficult task and the escalating violence in Iraq suggests that the results are far from certain.

Corporate Colonization

“Free Trade” is the Holy Grail of neoliberalism. It is essentially a public relations scam intended to disguise the shifting of wealth, jobs and resources from either the middle class or the public sector to the corporate and banking establishments.’ Despite the zealous cheerleading of Thomas Friedman and his ilk; the basic facts have been thoroughly examined and are not in dispute. Free trade has been a dead loss for everyone except the people for whom it was originally designed; the wealthiest and most powerful men on the planet. It has served them quite well.

For example, “since NAFTA went into effect in 1994, the US has lost over $4 trillion to foreigners through its trade deficit” . . ."During that 11.5 year period , foreign ownership of US assets skyrocketed an amazing 400 percent from $3 trillion to over $12 trillion” . . ."Foreign interests now own 46 percent of US Treasury debt, 26 percent of corporate bonds, and 13 percent of US corporate equities. Now nearly 100 percent of ongoing borrowings by the government are funded by foreign interests.” . . ."Foreign interests also control a majority of US domestic industries such as movies, music, publishing, metal ore mining, cement production, engine and power plant production, rubber and plastics and are major owners of US industries such as pharmaceuticals, chemical manufacturing, industrial machinery manufacturing, motor vehicles, and electronic equipment and components . . . In addition, the US has lost 3 million manufacturing jobs over the last decade, real wage growth after inflation has been essentially zero,” and personal debt has never been higher. (Data from Thomas Heffner EconomyInCrisis.org)

Since 1980, 13,730 major companies have been sold to foreign corporations. We no longer produce what we need to sustain ourselves.

These facts may have a mind-numbing affect on the reader, but they make a point that is simple and unavoidable. The country is being colonized by corporate predators and its main assets are being sold off to the highest bidder. This rampant carpetbagging is taking place in full view of the American public that still clings to the spurious idea that “free trade” is generally beneficial for all. It is not, and we are about to experience its full-effects as America’s “straw house” economy topples from its loss of manufacturing-capacity and its staggering account imbalances.

“Foreign investors now own 46 percent of US Treasury debt” over $3 trillion dollars! The Federal Reserve and its corporate wolves are planning to prolong the hemorrhaging of US wealth as long as possible, extracting every last farthing from the prostrate corpse of the waning republic.

Now, we are at the brink. Energy prices will go higher after the elections, manufacturing will continue to flag, and the housing Zeppelin is drifting towards the high-tension wires. To make matters worse, the American consumer; the “engine for global economic growth,” is drowning in a sea of personal debt.

There’s no place to go but down.

Every part of this bleak picture was anticipated by its architects. That’s why they hastily slapped together the requisite legislation for a modern day police state. After passing the Military Commissions Act of 2006 (which allows the president the arrest whomever he chooses without charges) and overturning the Posse Comitatus Act (the president is now free to deploy the military within America against US citizens), the Bush administration is as ready as they can be. Apparently, they feel like they can manage the public shock and outrage with detention camps and water cannons.

We’ll see.

In any event, the trap has been set and any minor disruption in the hedge funds or derivatives markets will put the economy into a violent tailspin forcing our "Decider” president to activate his plans for the new world order.

Battle Stations, Battle Stations

Last week an article by Ambrose Evans-Pritchard appeared in the UK Telegraph, where he stated: “[Treasury Secretary] Paulson re-activated the secretive support team to prevent markets meltdown. Judging by their body language, the US authorities believe that the roaring bull-market is just a sucker’s rally before the inevitable storm hits. . . . the plunge protection team is a shadowy body with powers to support stock-index, currency, and credit futures in a crash. Otherwise known as the working group on financial markets, it was created by Ronald Reagan to prevent a repeat of the Wall Street meltdown in October 1987.” . . . Paulson has set up “a command center at the US Treasury that will track global markets and serve as an operations base in the next crisis.” (Members include the heads at Treasury, Federal Reserve and Securities and Exchange Commission)

Evans-Pritchard adds: “Mr. Paulson has asked the team to examine ‘systemic risk posed by hedge funds and derivatives, and the government’s ability to respond to a financial crisis . . . We need to be vigilant and make sure we are thinking through all of the various risks and that we are being very careful here. Do we have enough liquidity in the system?'’”

And, finally, Evans-Pritchard asks, "[Do] Mr. Paulson and Mr. Cox [SEC] know something that we do not: whether other hedge funds are in the same sinking boat as Amaranth Advisors and Vega Management, keel-hauled by bets on natural gas and bonds? Or whether currency traders with record short positions on the Japanese Yen and Swiss Franc are about to learn the perils of the Carry Trade, a high-stakes game of chicken where you bet against fundamentals with high leverage to make a quick profit. Everybody knows it will blow up if the dollar goes into free fall.”

So what is Paulson anticipating?

Gabriel Kolko offers us a clue in a CounterPunch article, “Why a Global Economic Deluge Looms,” “The entire global financial structure is becoming uncontrollable in crucial ways its nominal leaders never expected. Instability is its hallmark . . . Contradictions now wrack the world’s financial system, and if we are to believe the institutions and personalities who have been in the forefront of the defense of capitalism, it may well be on the verge of serious crisis.”

Deregulation and reduced market transparency have created a plethora of financial instruments that are relatively untested and extraordinarily volatile. By eliminating the rules of the game, market savvy investors have raked in the profits but reshaped the economic landscape in a way that no one can predict what the ultimate outcome will be. Hedge funds are now loaded with over-leveraged debt instruments that promise a generous return in an up tempo market, but certain doom in an economic downturn. Now, that all the arrows are pointed towards recession, the devastating effects of this new “liberalized” system will be felt throughout the global economy.

No one knows what is in store for these high-risk hedge funds which have only been in existence for a short time and into which Americans have dumped trillions of their hard-earned savings. As Kolko says, “The credit derivative market was almost non-existent in 2001, grew fairly slowly until 2004, and went into the stratosphere, reaching $17.3 trillion by the end of 2005.”

Is it any wonder why the main players at the Fed, the Treasury and the SEC are feeling a bit jittery?

Any shock to the markets could set off a system-wide catastrophe. Just this week, for example, Taiwan was bracing for a stock market crash following the surprise indictment of first-lady Wu Shu-chen. Even relatively small incidents like this on the other side of the world create the potential for contagion that can spread rapidly in this new world of globalized markets. The danger is even greater when those markets are built on foundations of sand.

Hank Paulson was doubtless selected as Treasury secretary as the best possible “industry-insider” to oversee the unwinding of America’s humongous account imbalances and flimsy “deregulated” markets. His job is to ensure that, at the end of the day, US banking giants, the Federal Reserve, and western elites still control the global economic system and that the dollar reigns supreme. Whatever happens to the American middle class in the process is of no consequence.

But Paulson faces an insurmountable task from this point on; fudging the numbers only works for so long. So far, the greenback has benefited from the manipulation of oil prices, but that will soon end. (Better “fill ‘er up” now) The US economy is a shriveled shadow of its former self; housing and manufacturing are in a shambles and growth depends entirely on the expansion of debt. As GDP begins to nosedive, foreign investment will dry up, capital will flee to more promising markets in Asia and Europe, and the American people will totter into a barren world of soaring unemployment, hyperinflation, and 1930s type deprivation.

Unsurprisingly, the Bush administration still believes that their plan to remake the world’s strongest economy into a corporate fiefdom is a prudent way to meet the exigencies of the new century. Their foolishness defies description.

The country is now facing a Chernobyl-type meltdown and there’s nothing we can do to stop it. The foundation blocks for sound economic growth and prosperity have been replaced by a misguided faith in military adventurism and police state repression. The results are plain to see.

We are now more vulnerable to a seismic economic event than anytime since the Great Depression. The corporatists and the money-enders have absconded with the nation’s wealth; gutting the manufacturing sector, creating enormous equity bubbles, and raffling off our vital industries to foreign predators. Their unchecked avarice has left the country teetering on the verge of ruin. At the same time, the Bush administration has sown dragon's teeth across the world; leaving the US with precious few friends who will throw us a lifeline when the ship starts listing.

Hard times are on the way; only this time it’ll be detention centers instead of soup kitchens.

Monday, October 23, 2006

Plants Think it's Spring

| |||

|

Plants Think it's Spring

| |||

|

Monday, October 16, 2006

Unholy Trinity Set to Drag Us into the Abyss

I can't agree more with this article. Government leaders are more concerned with galvanizing support for resource wars as well as propping up or toppling oil dictatorships around the globe. Can you think of any democratic oil powers/gas stations that are not commanded by despots, monarchs or dictators? What government leaders and their media lap dogs should be doing is pushing for new forms of energy that will weaken oil as a primary energy source, thus eliminating the need for global adventures, government overthrows, and increased violence and terror. What we need is public awareness, but when the media chimes in unison on the popular story of the day, we end up living in an information vacuum. Something's gotta give. Tell a friend!!

Unholy Trinity Set to Drag Us into the Abyss

By

Ian Dunlop

We are about to experience the convergence of three of the great issues confronting humanity. Climate change, the peaking of oil supply and water shortage are coming together in a manner which will profoundly alter our way of life, our institutions and our ability to prosper on this planet. Each is a major issue, but their convergence has received minimal attention.

Population is the main driver. In the 60 years since World War II, the world population has grown at an unprecedented rate, from 2.5 billion to 6.5billion today, with 9 billion forecast by 2050. That growth has triggered insatiable demand for natural resources, notably water, oil and other fossil fuels. Exponential economic growth in a finite world hitting physical limits is not a new idea; we have experienced limits at a local level, but we have either side-stepped them or found short-term solutions, becoming overly confident that any global limits could be similarly circumvented.

Today, just as the bulk of the world's population is about to step on to the growth escalator, global limits emerge that are real and imminent. The weight of scientific evidence points to the fact the globe cannot support its present population, let alone an additional 2.5 billion, unless we embrace change.

Climate change, peak oil, water shortage and population are contributing to a "tragedy of the commons", whereby free access and unrestricted demand for a finite resource doom the resource through over-exploitation. The benefits of exploitation accrue to individuals, whereas the costs are borne by all.

Examples at local level abound, include overfishing and interrupting river flows for farming and irrigation. One mark of a mature society is that equitable solutions are found to the "commons" dilemma, and we have been relatively successful in doing this at local level. However as these issues become national and global, solutions become harder. For climate change, peak oil and water, the ultimate "commons" is the earth's atmosphere which we have been using as a garbage dump for carbon and other emissions.

As Aristotle said: "What is common to the greatest number has the least care bestowed upon it. Everyone thinks chiefly of his own, hardly at all of the common interest." In an underpopulated world this may not matter, but in our overpopulated world it is disastrous.

Solutions require that we move beyond narrow national self-interest, take a global view and place our society and economy on a genuinely sustainable footing. Sustainability, "meeting the needs of the present without compromising the ability of future generations to meet their own needs", encompasses the entire basis upon which global society operates, not just the environment. It requires realigning our ethical framework, moving away from the winner-take-all individualism which has created so many of the "commons" problems, to a more co-operative individualism, where managing the global and local "commons" is paramount.

Rather than the negative, focusing on supposed job cuts and fear of change, we should focus on the positive: we have a unique opportunity to set humanity on a new course, built around an ethical renaissance and sustainable societies. Undoubtedly there will be pain in the short term as conventional politics, economics and business models are turned on their head. However, the tools and technologies to solve these problems are available, the cost is less than we have been led to believe, and the benefits greater. Further, change can be achieved rapidly given the right impetus.The missing ingredients for change are acceptance of the problem, the collective will for action and genuine long-term vision and leadership. Given the dominance of short-term pragmatism in our political and corporate cultures, it is likely our leaders will continue to procrastinate and not rise to the challenge. The pressure for change must come from the community at large, where it is building toward a "tipping point" which will force a fundamental realignment of political and corporate attitudes.

Historically, this has rarely happened without a crisis. Fortunately the trinity are about to trigger that crisis with a prolonged period of "creative destruction" which will radically transform society and economy whether we like it or not. Our stark choice is either to embrace the tipping point bearing down upon us, seizing the opportunity to build a sustainable future, or fudge the issue, try to muddle through in the time-honoured manner and increasingly lose the ability to control our own affairs.

For Australia, along with many other countries, water is the priority. Resolving the water crisis will be the first test of whether we can combine long-term vision and principled leadership with the need to take the hard decisions quickly enough to stave off impending disaster. If so, it will stand us in good stead to tackle the even greater tasks ahead.

Formerly an oil, gas and coal industry executive, Ian Dunlop chaired the Australian Coal Association in 1987-88 and chaired the Experts Group on Emissions Trading of the Australian Greenhouse Office in 1999-2000.

Friday, October 13, 2006

Economic Growth Will Drive Biofuel Industry

| Global demand for food and alternative fuel source - particularly in Asia - will stimulate new era say experts. |

| Mike Wilson |

| Growing demand for food to feed a more prosperous world population, and the quest for alternative fuel sources to supply expanding energy needs, will fuel the development of a new era in bioenergy, say experts gathered in St. Louis this week to discuss renewable fuels. And the key area to watch is Asia.

Patricia Woertz, CEO, Archer Daniels Midland “Economic growth is driving these developments,” notes Patricia Woertz, CEO of Archer Daniels Midland, a leading supplier of ethanol. “Global real GDP growth is expected to average 3.8% annually through 2030. But it is economic growth in Asia projected to average 5.5% per year that is shaping world scenarios - in particular China, with a 6% GDP followed by India at 5.4%.” Woertz and other blue-ribbon speakers addressed an audience of 1,300 at the Advancing Renewable Energy Conference, jointly sponsored by U.S. Department of Energy and U.S. Department of Agriculture. She says incomes are rising in Asia and societal change is following a familiar path: people migrating from rural to urban areas and improving their diets along with incomes. And energy consumption is rising. “China is already the second largest oil importer in the world and represents over 30% of the annual increase in oil consumption,” she says. “Most of the growth is happening in the transportation sector. With car sales topping 5 million last year, China is already the world’s third largest car market after the U.S. and japan, and some auto industry analysts expect China to surpass Japan in the next two or three years.” Long term projections While these trends could be upset by geopolitical turmoil or economic recession, there’s no doubt long-term growth in To meet projected demand for fuel through 2015, the world would have to add capacity of 9.5 million barrels a day - the equivalent of four new refineries as I as the largest refineries in the world - every year for nine years. However, the “The answer to that question will be significantly influenced by the desire for energy security, for strong ag economies and for environmental improvement,” says Woertz. “These desires are already shaping world energy policies and driving market growth.” Woertz cautions anyone who may discount the potential expansion opportunities for ethanol or biodiesel based on current technologies. Those will change and get better, she predicts. She compares biofuels to the automotive industry at the start of the 20th century, or the microchip industry in the 1980s. “They were budding industries with enormous potential over an undetermined timeframe,” she concludes. “And within these industries, technological innovation drove change and with this change came significant improvements in product quality, in cost to consumers, and in the quality of life.” |

Thursday, October 05, 2006

Arctic Sees Near-Record Melt in 2006

By CLAYTON SANDELL

Oct. 4, 2006 — Summers in the Arctic Circle could be ice-free in about 50 years if current melting trends continue, according to new projections by scientists at the National Snow and Ice Data Center.

What causes alarm among scientists is the rate at which the summer arctic sea ice is disappearing, at about 8.6 percent per decade.

At that rate, scientists warn, the Arctic could be completely free of ice by about 2060 — about a decade earlier than had been previously predicted.

"If this pattern continues, we're going to lose it pretty soon," said Mark Serreze, an arctic climate research scientist at the National Snow and Ice Data Center in Boulder Colo.

In 2006, a pattern of "sharply declining" arctic sea ice continued, according to the National Snow and Ice Data Center, and nearly broke the 2005 record.

Researchers point out that for the first six months of this year, the amount of sea ice was well below the 2005 minimum, thanks to warm winter temperatures and unusually high temperatures in July. Had August not been unusually cool and stormy, Serreze said, 2006 would have almost certainly broken the 2005 record for minimum sea ice extent.

"Clearly, the sea ice is not feeling well," Serreze said.

Since the 1960s, sea ice has also become thinner. It's lost on average 10 to 15 percent of its thickness, and as much as 40 percent is some areas, according to the Arctic Climate Impact Assessment.

Arctic sea ice plays an important role in balancing Earth's temperatures. Air and ocean currents carry heat energy away from the tropic regions to the Arctic, which acts as a sort of air conditioner. Without it, said scientists, the tropics would overheat.

The Arctic region is particularly vulnerable to warming. The white sea ice reflects much of the sun's heat back into space. But as melting occurs, the white ice is replaced by darker ocean water that absorbs more heat energy, which in turn causes increased warming. It's called a feedback loop.

In addition to sea ice, scientists say the effects of global warming can be seen all over the Arctic region. Areas of permafrost are thawing, the Greenland ice sheet— 2 miles thick in some places — has accelerated. The melting ice also deprives polar bears of the habitat they need to hunt.

Tuesday, July 11, 2006

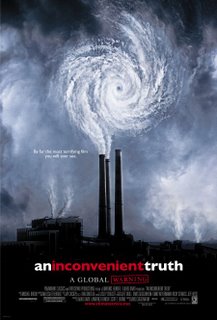

Kudos to Al Gore

After seeing droves of people waiting to watch Pirates of the Caribbean last Saturday, I wondered why not many were as enthusiastic to watch Al Gore's movie, An Inconvenient Truth? Ok, so Al Gore may not be as appealing to young teens, or even to adults as hunky Johnny Depp, dreamy Orlando Bloom, gorgeous Keira Knightly or some sweet special effects, but if Gore's movie does not stir a fire under one's ass I don't know what will.

After seeing droves of people waiting to watch Pirates of the Caribbean last Saturday, I wondered why not many were as enthusiastic to watch Al Gore's movie, An Inconvenient Truth? Ok, so Al Gore may not be as appealing to young teens, or even to adults as hunky Johnny Depp, dreamy Orlando Bloom, gorgeous Keira Knightly or some sweet special effects, but if Gore's movie does not stir a fire under one's ass I don't know what will.

To put it bluntly we are screwed as a species unless we do not change our polluting habits. Many of us think someone else like the government, Tom Hanks, or Jesus Christ will fix Global Warming. But today's mass media has the collective oil company shaft so far up the yazoo they will not give us the truth unless we citizens demand it.

The Oil companies for years have been sabotaging efforts to replace the combustion engine and they have launched media campaigns to obfuscate/hide the truth to global warming. The reason why the public thinks global warming is controversial is because the oil companies and their media lap dogs have launched a campaign to fool us. All credible scientists and their data show Global warming IS FOR REAL! Enough is enough! Wake up, take action, go see Gore's movie! Please do it for your future children and grand children. If you don't have or want kids than see it for the other children in your family. If you are Republican then seeing this movie will help the economy...and see it for yourself. If Florida, Bangladesh, and lower Manhattan go under water, it will be our faults. Yes, it's true, the ice caps are melting.

*** If you do not forward this article to everyone, millions of polar bears will take to the streets!! Forward it to everyone so we can educate ourselves and take responsibility for our future***

Things you can do to reduce global warming:

http://www.globalwarming.net/

Moe

A watershed on energy?

The nuclear decision matters, but it's important to read beyond the headlines of today's report.

By John Vidal

The Guardian Online

Nuclear power is back. Well, it was never much of a secret that Mr Blair was going to opt for the most controversial power source that the world has ever known, but the official decision is still significant.

It means that the British nuclear industry, which has self-confessedly botched its finances for two generations and left future governments with a £70bn decommissioning bill as well as a £10bn mountain of radioactive waste to clear up, can carry on as if its sorry past had never happened.

It means that the lights will still be on in 15 years' time, but it also means that future generations will question what our fixation in the early 21st century was with a technology born of a dreadful war 60 years war before, and which has needed unimaginable subsidies to survive ever since.

When in 50 years time our grandchildren start to clear up the mess that this new generation of nuclear power will make, they may well wonder if we saw things clearly. Did we really need to replace nuclear power with nuclear, they may mutter as they keep paying the bills and filling up the caverns with the waste? How come this government surrendered to the interests of a few mighty industrial conglomerates?

But this energy review, the second in three years, is far more than a justification of nuclear power. It may also be justly remembered as the moment when an oil-obsessed, energy-profligate department of industry read the runes and began a slow turn towards creating a low-carbon economy in response to climate change and future energy shortages.

And it could also mark the moment when the penny finally dropped across all government that it's not efficient to pollute, and that there's more money to be made in saving energy than in generating it. Even if there are no firm policy commitments, in that sense the review is a triumph.

Increasing the renewable electricity target to 20% by 2020 is still nowhere near enough to meet the real challenge of climate change, and increasing the biofuel target to 10% is no more than Brussels already demands, but it is the tone of the report that marks a real change. The language is one of potential and possibility, for the individual as much as for business and local government.

For the first time, the national emphasis has been put on the decentralisation of energy, away from the Stalinist-style central planning that has marked energy generation for the last 60 years. From now on the individual household or business will be encouraged to generate its own power with micro-generation and to save energy as never before. The possibility is even held out of emission trading between individuals. In energy terms, all this is pretty revolutionary, the beginning of a green philosophical change as significant as Margaret Thatcher's determination to extend home ownership to everyone.

But there are great dangers implicit in the review, too. New planning laws will be needed to overrule objectors, whether of onshore wind power or nuclear. We can expect bitter battles on the hillsides and in the town halls. The review may lead directly to mega-schemes like a Severn barrage, which will be massively opposed. The trade-off in visual terms may be dramatic. Great swathes of Britain may be put to growing energy crops. Hillsides may become crowded with turbines. Forcing Scotland and Wales to bow to nuclear and wind power will be divisive.

But, in the end, the whole stated point of the review was to chart ways forward to stave off climate change. As the Tyndall Centre for Climate Change Research wisely remarked this afternoon, this was not so much a review of energy so much as one of electricity generation. It deliberately did not address transport, which uses one third of all the energy we use, and it barely got to grips with energy saving.

Seen like this, the decision to continue with nuclear power - which actually only provides 3.6% of the energy we use to move our machines and ourselves and to light and heat and cool our buildings - is pretty marginal.

Friday, June 09, 2006

Oil, Zarqawi, Recession?

If you look at the yield curve below, you'll see it's almost inverted. The 2-year note is 4.98% and the 10-year is 5.02. Inverted yield curves, for those of you who don't know, have been a reliable economic indicator of a coming recession. The yield curve was inverted earlier this year. If the yield curve inverts and/or the U.S. economy goes into recession, mortgage rates are going to fall.

Forbes just posted an article about a coming recession

http://www.forbes.com/home/investmentnewsletters/2006/06/06/stack-recession-in_js_0606soapbox_inl.html

Peak Oil Passnotes: Zarqawi Don't Drive

By Edward Tapamor

So Zarqawi is dead, oil drops by a buck and a half and suddenly the world seems a great place again. Not.

If ever there was a pointer to the underlying fundamentals of the oil and products market right now it was this one incident. Zarqawi had supposedly been the head of Al-Qaida in Iraq, although the whole idea of Al-Qaida even having a head seems faintly ridiculous to those who have studied the transient grouping.

When he is killed in the US bombing raid the mainstream media, and the various interested politicians, trumpet this as some kind of huge success. Sure he may well have done some very bad things, but he is not the cause of Iraq's collapse. That is something rightfully shared out between Saddam, President Bush, Prime Minister Blair, all of Saddam's previous supporters from France, Russia and China to the USA and all the conniving middle eastern governments you can think of. As well as the self-serving malcontents who make up the laughable attempt at a government now in Baghdad.

Zarqawi was a bit part player who came in at the end with a penchant for self-publicity and bloodshed. Like so many other players in the region. But his death drove down the price of crude landing thousands of miles away in Cushing.

We could not hope to spell it out any clearer than this. It is ridiculous. Geo-politics are the driver of the energy price, they will remain so. They are mixed in with the herd like reaction of the markets. They are mixed in with increased demand, maturing fields (or `peak oil` if you like the contaminated brand name) and daft investment cycles that have culminated in a terrible lack of spare capacity. But do not take it from me, take it from Alan Greenspan.

Just before Zarqawi's death Greenspan pointed out that "the buffer between oil demand and supply is so precarious that even small acts of sabotage or local insurrection have a significant impact on oil prices."

The part of the phrase we should be looking at is "small acts," with the emphasis on "small." The globalisation of the energy market place - just like so many other market places - means that even "small acts" like the death of Zarqawi can rattle institutions, shake the money tree and even end up affecting the lives of ordinary people who cannot even spell Zarqa…Zaqraw…the dead guy's name.

If one sits down and just has a brief look at history do we expect some kind of huge wave of peace to envelope us all in the next six months, year, five years? No we do not. There is no respite from high energy costs just because of an internal struggle in the White House finally putting forward some half decent rhetoric to Iran. Does anyone think this rapprochement will last? If so for how long?

Nor is there any respite from high energy costs because the Nigerian oil minister says they are going to add 1.5 million barrels per day of supply in the next fifteen months. Or that Mexico has found the new Cantarell. Or that Saudi Arabia say they can add gazillions of barrels to its reserve estimates, because none of it is true.

The hole Pemex drilled offshore Mexico is not only not the new Cantarell, it is not even the new hole. It seems hard to believe that almost all the mass media were captivated by such a brazen load of rubbish as that day when pre-election Vincente Fox welcomed the `discovery`. These are the games played out in front of our eyes, do not believe them.

We are in a time of high energy costs period. There is one thing and one thing alone that can bring them down and that is a recession. There will be no downward drivers of the oil price from the peace camp, no drivers of the oil price from renewed investment, more wars, superb exploration techniques or better technology. And there will certainly, never again be a man called Al-Zarqawi driving the oil price. That small act we can agree on.

Saturday, May 13, 2006

General Report on $100 Oil

Oil prices declined after the Goldman forecast before picking up steam later in 2005 following the massive hurricanes in the Gulf of Mexico. After setting record highs, prices retreated again.

Supply concerns and steady demand growth have pushed oil prices to a new all-time record of over $75 per barrel this year. Worsening political situation in many oil-producing countries have heightened the supply concerns and oil at $100 per barrel does not sound incredible any longer.

Geopolitical supply shock triggers

Though the current oil boom is essentially a result of increasing energy demand from emerging economies like China and India, supply disruptions have played a significant part in taking prices to record levels.

The ongoing war of words between Iran and western countries over its nuclear programme could escalate further, leading to economic sanctions and even a military conflict. If supplies from Iran — the second largest oil exporter — are disrupted, crude prices are very likely to climb to $100 per barrel.

But will the two sides let it go as far as that? The US is wary of another military conflict in the Middle East while it is already embroiled, some say inextricably, in Iraq. It may not even allow Israel to go in for an air strike on Iranian nuclear installations, as some commentators believe.

A military strike on Iran and a runaway rally in crude prices would create a difficult domestic situation for any US administration. Even though it has not directly affected US consumers much, their support for US policy on Iraq has declined steadily. It is less likely that American public would support such an action against Iran.

US politicians are already worried about retail petrol prices of over $3 per gallon and it would be all the more difficult for them if prices rise to $4 or even more.

For all its sabre-rattling, Iran would also be extremely cautious about further escalating the dispute. The Iranian president has reportedly sent a letter to the US president — the first formal communication in decades — suggesting possible solutions to various disputes between the two antagonists. It would be in the best interests of Iran to keep the region peaceful and build its economic might with the significantly higher cash flows from record oil revenues.

Iraqi oil production has declined substantially over the last decade and even the unlikely scenario of a total shutdown following an all out civil war would only have a modest impact on oil prices.

However, such a conflict has the potential of sucking in neighbouring countries into it, which could destabilise the entire region. On the other hand, if the new government can restore the rule of law, increased supplies from Iraq would have a calming impact on prices.

The domestic political situation in Saudi Arabia — the largest oil exporter — has been a source of concern, albeit a mild one, for the oil markets. Recent developments in the kingdom have helped calm those concerns though long-term worries still remain. The transition of power last year following the then king's death was smooth and the country has initiated some political reforms.

South American oil producing countries, all of them have leftist rulers, are using high oil prices to score brownie points against the US administration. Flamboyant Venezuelan leader Hugo Chavez has become the cheerleader of this group as his country is the fifth-largest oil exporter and a major supplier to the US.

Last month, Bolivia surprised the energy markets by nationalising the oil and gas sector and sent troops to oil installations. Last week, Venezuela announced plans to increase tax revenues from oil production. These actions may lead to only short-term rallies in oil prices at present, but their impact would be considerably higher if prices move closer to $100.

The situation in Nigeria, another large exporter, remains volatile. Successive Nigerian rulers have appropriated for themselves or squandered the country's oil wealth for the last many decades. A former Nigerian military dictator built a personal fortune of more than $5 billion through oil deals.

It is estimated that more than 20 per cent of Nigerian production capacity is currently disrupted because of militant strikes. The situation may remain the same unless the country takes steps to ensure that at least a part of the oil wealth reaches the people.

Though any of these geopolitical developments can influence oil prices, only a military conflict involving Iran can possibly take prices to $100 all by itself. A combination of adverse developments in multiple locations also has the potential to cause such a spike in the medium term.

How long will the reserves last?

Oil reserves have always been a hotly contested topic among producers, industry experts and analysts. Total proven reserves across the globe, as per OPEC data, are around 1.14 trillion barrels — OPEC countries account for more than 78 per cent with their 897 billion barrels of reserves.

Sceptics argue that data on oil reserves, especially for OPEC members, are highly inflated. Production quotas allotted to OPEC members are linked to their reserves. Some analysts say this policy has prompted many producing countries to overstate their reserves.

The most optimistic forecasts are from OPEC and Exxon Mobil, as can be expected. According to these forecasts, oil production would touch a peak of around 115 million barrels per day between 2015 and 2025, maintain that level and start declining from 2050 onwards.

The International Energy Agency (IEA) expects a higher peak of 120 million barrels per day by around 2030. But the IEA expects the decline to start earlier by 2040, declining to as low as 70 million barrels by 2050.

More sceptical analysts estimate that global oil production would peak by 2010 at around 90 million barrels per day and then decline gradually.

These estimates are on the assumption that no new major fields would be discovered or significant technologies, which would substantially increase recoverable reserves, would not emerge. Typically, only 40 per cent of in-place reserves in a field are recoverable.

Shortage of refining capacity

Because of low margins, which prevailed for most of the '80s and the '90s, additions to refining capacity were very low. After a significant jump in the '90s, global refining capacity declined in the '80s before climbing again in the late '90s. Tough environmental regulation in western countries also contributed to this slow growth in refining capacity.

Total global refining capacity is currently at around 88 million barrels per day. At average refinery utilisation of around 95 per cent, provided there are no natural disasters like last year's hurricanes in the US, actual throughput would be around 84 million barrels.

Global demand for the current year is projected at close to 85 million barrels, which would see a marginal shortfall in refining capacity. If there were any disruptions, the shortfall would go up.

To make matters worse, most of the refineries in western countries can process only lighter grades of crude oil. Availability of lighter crude has declined as most of the new oil fields produce heavier grades.

Modern refineries, like the Jamnagar unit of Reliance, are very complex and have the flexibility to process different grades of crude. That explains the interest shown by global oil major Chevron in the proposed Reliance Petroleum refinery, which would be more complex than the existing Jamnagar refinery.

Shortage of refining capacity has pushed up prices of refined products like petrol in recent years. As product prices rise, refiners would be willing to pay more for crude oil to ensure supplies.

This situation is expected to continue for the next few years as new refining capacities being planned would take at least three years to start production. Currently OPEC countries are planning capacity additions of close to 4-million barrels per day, which would come on stream by 2010.

Impact of speculation

Independent analysts and OPEC officials alike estimate that nearly 20 per cent of the current oil price surge can be attributed to heavy inflows from investment funds into oil futures. Trader activity in oil futures has more than doubled over the last couple of years as evident from the surge in volumes and increased volatility.

Interestingly, some of the investment banks making forecasts of high oil prices make a significant part of their earnings from trading activities. Among leading global investment banks, Goldman Sachs is one of the most active in commodity markets, leading to speculation whether its highly bullish reports are used to influence prices.

Speculative activity in commodity markets and the consequent price movements have a significantly higher impact on the economy than such activity in stock markets. Significant price volatility in commodity futures can throw the physical markets for those commodities into disarray.

While the participation of investment funds and traders do provide the markets with considerable liquidity, the extremely low participation of actual producers and consumers remains a concern. When crude oil futures were launched in India by MCX, it was declared that companies who are major consumers of petroleum products would benefit considerably.

However, the participation of even large professionally run companies with sufficient competence to hedge their future requirements remains low. This has made the commodity markets highly one-dimensional and volatile.

The push for more discoveries

New oilfield discoveries have declined steadily since the '60s when some of the largest fields in the Middle East were discovered. Most of the significant discoveries of recent years are extensions of the existing fields. More than 95 per cent of all discoveries in recent years have been of small reserves.

The more pessimistic among industry analysts believe that all large oil reserves have already been discovered on the simple premise that bigger fields are easier to spot. It is unlikely that large onshore reserves at accessible depths have been left undetected after decades of extensive exploration.

Hence the possibility of large discoveries exists only in deepwater offshore blocks. Exploration in these blocks is very costly and production is viable only if prices are sustained at these levels. As there is no certainty about prices, investments in deepwater exploration has been slow to pick up.

The five global oil majors — BP, Shell, Exxon Mobil, Total and Chevron — spent a total of $44 billion in exploration during 2004 as compared to $41.4 billion and $45.5 billion for the previous two years. As a percentage of total revenues, spending on exploration has declined steadily to 3.57 per cent in 2004 from 4.24 and 5.25 per cent for the previous two years.

These large oil companies made the mistake of overspending on exploration during the previous oil booms and paid for it when prices corrected. This time around, they cannot be blamed for being cautious even as their bottom lines hit record levels. Diminishing returns from exploration over the last couple of decades have made them all the more hesitant.

Till about mid-'80s, more oil reserves were being found than being consumed every year. This has changed drastically and currently new discoveries are at just one barrel for every four barrels of consumption.

Alternate energy sources

Development of alternate energy sources becomes a jmajor policy issue whenever oil prices surge. This time, the US government has already made considerable comments about other fuels like ethanol and is talking of a long-term strategy to reduce dependence on fossil fuels.